mPokket Instant Loan App: The mPokket App provides instant personal loans ranging from ₹500 to ₹30,000 in just a few minutes, making it a reliable choice for over 1.5 crore Indians. Whether you’re a salaried employee or a student, mPokket offers quick financial help with minimal documentation, low transaction fees, and flexible repayment options. mPokket is widely trusted, It has become one of India’s top-rated online loan apps, especially for students and salaried individuals looking for quick and easy loans.

Key Features mPokket: Instant Loan App

- Instant Loans: Get personal loans up to ₹30,000 within minutes.

- Flexible Repayment: Repayment tenure ranges from 61 to 120 days, with rewards for timely payments.

- Low Fees: Processing fees range between ₹50 to ₹200, plus 18% GST, depending on the loan amount.

- Competitive Interest Rates: Interest rates range from 0% to 4% per month, with a maximum APR of 142%.

- Instant Cash Transfer: Loan amounts are instantly transferred to your bank account or Paytm wallet. A dedicated team is available round the clock to assist users.

- For Students: Flexible repayment plans make it easier for students to manage their finances during their studies.

- For Salaried Professionals: Quick loans act as salary advances, helping you handle unexpected expenses efficiently.

- Secure and Reliable: The app is 100% online and safe, with a 4+ star rating, solidifying its reputation as one of the best loan apps in India.

| Amount | Codes | Claim Here |

| 20 | FFCMCPSJ9*** | Claim Now |

| 40 | XZJZE25WE*** | Claim Now |

| 60 | FF9MJ31CX*** | Claim Now |

| 100 | UVX9PYZV5*** | Claim Now |

| 150 | MCPW3D28V*** | Claim Now |

How to Take a Loan from mPokket App?

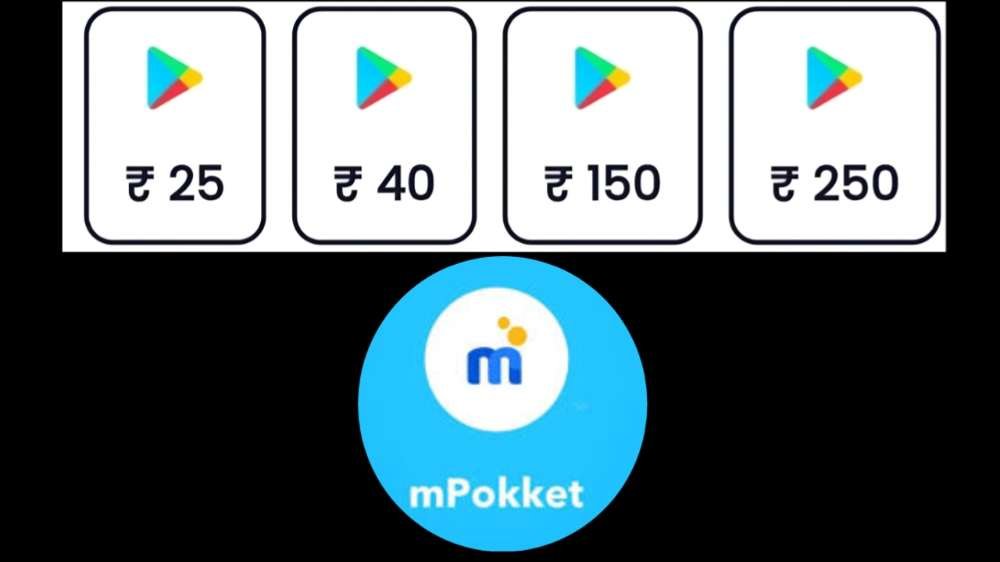

- Download the mPokket App: Available on both the Google Play and Apple App Store.

- Sign Up: Create an account using your email or mobile number, and provide accurate personal information.

- Verify Your Identity: Upload the necessary documents, including your college ID (for students) or salary details (for professionals).

- Request a Loan: Select a loan amount between ₹500 and ₹30,000 based on your eligibility.

- Choose Repayment Period: Pick a tenure from 61 to 120 days.

- Receive the Loan: Once approved, the loan will be instantly credited to your bank account or Paytm wallet.

mPokket is the ideal solution for those seeking fast, reliable loans, helping you cover emergencies or unexpected costs in no time.

Fkkggnmn k

Mohit

PLKM-UJNB-VG**

Good morning sir ji hi boro mobile thozhangirchi boro boro mobile mesek ka se call pannatiya tha hi to all the best to airtel free movie app ka se hi bhej dena hi nahi aaya tha to airtel se call kar raha hu to kha hi hi hi boro hai hi boro mobile mesek ka se hi nahi hai hi nahi hai abhi hi boro hai

duh-hjeuduu+4hhghdjrjfckfjf

Saf

6