True Balance is a trusted platform offering safe and secure financial services, including loans and payments, with the mission of “Finance For All.” With over 75 million users across India, True Balance is known for its user-friendly UPI payments and personal loan services. You can apply for an online personal loan ranging from ₹1,000 to ₹1,25,000 for a tenure of 3 to 12 months, with minimal processing fees. The APR (Annual Percentage Rate) ranges from 60% to 154.8%. Apply for a personal loan today and experience hassle-free borrowing with True Balance.

True Balance holds a PPI license and provides an RBI-compliant wallet, offering secure and convenient payment methods. The app also partners with NBFCs to provide online personal loans. Getting a loan through the True Balance app is quick and easy. Follow these steps to apply for and receive a loan directly into your bank account.

How to Take a Loan from TrueBalance App

- First, download the True Balance app from the Google Play Store. Install the app on your smartphone.

- Open the app and register using your mobile number. If you’re already a user, simply log in.

- After logging in, you’ll be prompted to check your eligibility for a loan. Provide basic information such as your PAN card number and income details. The app will instantly evaluate your eligibility.

- Once eligible, select the loan amount you wish to borrow. You can apply for a loan between ₹1,000 and ₹1,25,000. Choose your preferred repayment tenure, which can range from 3 months to 12 months.

- Upload the necessary KYC documents such as PAN card and proof of address This process is fully digital, so there’s no need for physical paperwork.

- Once you’ve submitted your documents, True Balance will process your application. If approved, you’ll receive confirmation within minutes.

- After approval, the loan amount will be disbursed directly into your bank account. The entire process is fast; you can expect the money to be transferred quickly.

How to Redeem TrueBalance Personal Loan Codes?

- Open the TrueBalance app.

- Go to the Redeem section.

- Enter the redemption code and claim your reward instantly.

Features of True Balance Loan App:

- Loan Range: ₹1,000 to ₹1,25,000

- Fully Digital Loan: 24/7 access to loans and payments, Longer tenures, and attractive interest rates.

- Instant Loan Disbursal: Directly to your bank account

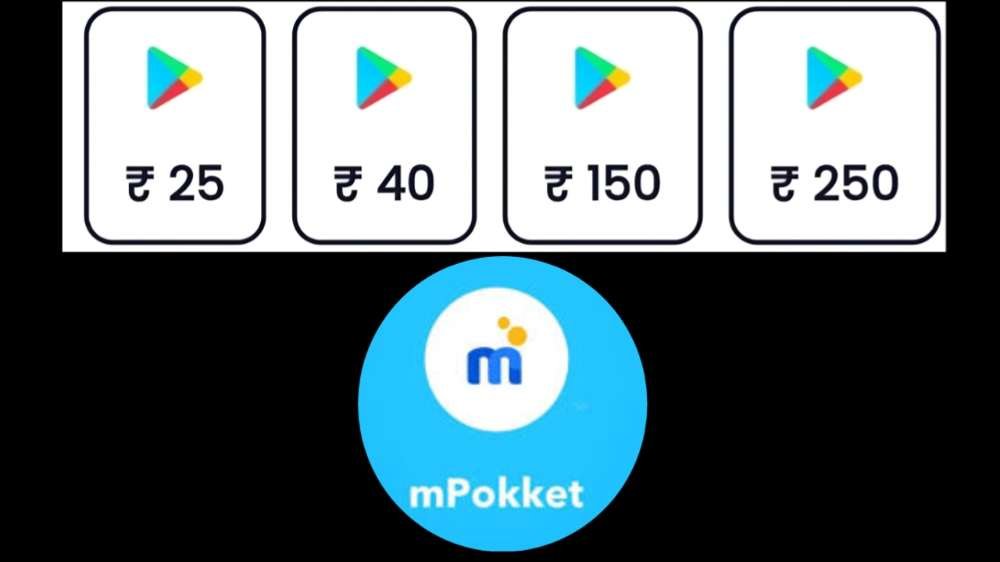

- QR Loan Payments: Pay at offline shops with any QR code scanner. Choose from Net Banking, Credit/Debit Cards, and Gift Cards

- Improved Credit Score: Timely repayments boost your credit score and increase loan eligibility

Safe and Secure Loans: True Balance offers a secure and encrypted loan application process. With a 4.0+ star rating, it is one of the top online loan apps in India, ensuring the safety of your information.